What Is A Cash Advance Fee On A Credit Card?

Triston Martin

Sep 22, 2022

You would need to take out a cash advance to get cash using your credit card account. This includes sending money to pals using applications like PayPal, Venmo, or MoneyGram. Using a credit card cash advance is similar to taking out a loan. However, cash advances from credit cards come with fees and, in certain circumstances, withdrawal limits. With that in mind, Better Money Habits® spoke with Bank of America's Senior Vice President, Consumer Card Products, Jason Gaughan, to learn more about the factors to consider when taking out a cash advance on a credit card.

How Do Cash Advances Operate?

When you get a cash advance on your credit card, the corporation is effectively lending you the money and charging you interest, as opposed to when you use your debit card to withdraw money from your account. Cash advances typically include a greater annual rate and transaction fee (APR). The amount of money you can borrow through a cash advance is also typically capped. But there are other ways to get a cash advance besides just using your card to get cash. Some credit card issuers mail out checks to their consumers. These checks, commonly referred to as "convenience checks," are associated with your bank account. If you put money into the account, it will be treated as a cash advance, and the cash advance interest rate will apply. Moreover, there could be transaction costs involved.

Cash Advance Considerations

Getting a cash advance can be a lifesaver if you ever need quick cash. You shouldn't count on cash advances as a regular source of finances, but they can come in handy if you're low on cash and have no other options for paying for an unexpected need. That said, it's important to weigh the prices of each alternative carefully.

What Is The Cost Of A Cash Advance?

The cost of a cash advance includes the interest rate on the borrowed funds, the amount of money you withdraw, and any related fees. A cash advance will accrue interest until it is repaid. It's important to remember that most services will charge you a fee every time you take out a cash advance.

Cash-Advance Interest

Interest is normally charged on cash advances first from the date of the purchase until the sum is paid in full. Contrast this with the interest-free grace period often extended on credit card purchases. Cash advances often have a higher interest rate than regular purchases. Excluding no-interest cards, the aggregate prepaid card rate among personal credit cards within Canstar's database is 19.40%. The average buying rate, meanwhile, is 16.90%.

Cash Advance Fee

If you take out a cash advance, expect to pay more than just interest. This can be a set dollar sum or a proportion of the cash advance. According to Canstar's data, the typical flat fee is $3, while the typical proportion fee is 2.69 percent of the amount withdrawn. As of this writing, 3.5% is the highest percentage cost, and $5 is the highest flat price for cash advances on personal credit cards in our database. The cash advance fee will be added to your current cash advance balance at the time of the transaction. If this is the case, then you can expect to pay interest.

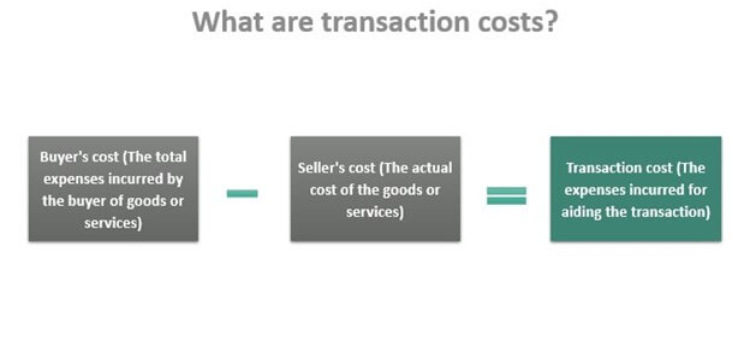

Learn the Costs of Transactions

In cases when the cost is a part of the total advance, you can reduce it by withdrawing only the amount you need. The costs associated with other transactions can be either flat rates or a mixture. If you withdraw the total amount of money you anticipate needing at once, you will incur the flat cost only once rather than making several smaller withdrawals.

Conclusion

He advises considering whether or not the business you wish to pay would accept credit cards as payment, and if not, forego the purchase. Don't count on this as a first option if you're short on funds. To make ends meet this month, you might have to cut back on something else or use money from your savings account if an unforeseen expense arises. Alternatively, you might always have a modest amount of cash in an emergency. That way, if you ever need cash, you won't have to pay to acquire it.