What is the Difference Between the Credit Card Statement Balance Vs. Current Balance?

Triston Martin

Oct 07, 2022

Introduction

When you glance at your credit card statement or log into your account online, you'll come across various phrases and definitions. Statement balance and available balance are two terms that frequently confuse. The statement balance only reflects the charges and payments made during the most recent billing cycle, while the current balance shows the full amount owed on the credit card as of the current date. Your credit score is calculated using both your current and statement balances. The key distinction is as follows: The difference between your current balance and statement balance is the amount you owe at any time during the billing cycle.

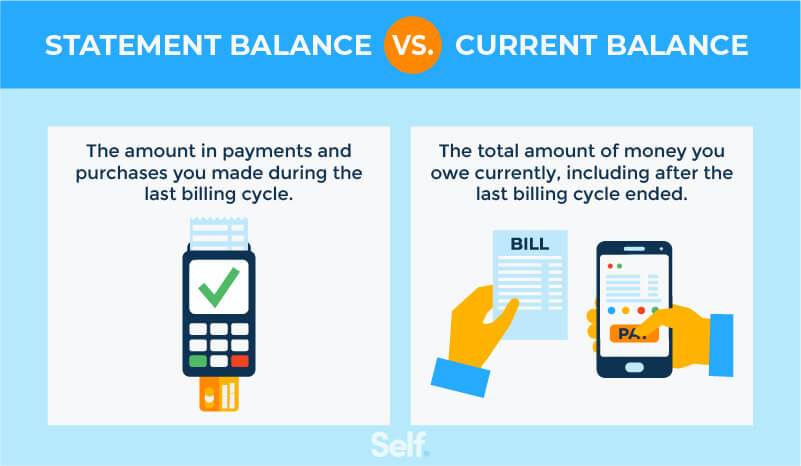

What Is a Statement Balance?

Your purchases and payments for a given billing cycle are summarised on your statement balance. The billing cycle for your credit card can vary from one card issuer to the next. Usually, a billing cycle lasts around 30 days, but you should double-check the specifics with your card issuer or agreement. It's not likely that your payment date will fall on the 1st or the 30th of the month. Setting up your monthly budget around the first and last of the month could throw off your calculations. Your credit card statement is created after your billing period concludes. Once your statement has been generated, any changes to the statement balance will not be reflected until the end of the following billing cycle.

What Does The Current Balance Mean?

As opposed to your statement balance, which only reflects charges and payments made during a specific period, your current balance includes all charges and payments made to your credit card account until the date the statement was generated. The difference between your current balance and your statement balance is subject to change. The amount you owe on your credit card will be updated every time you make a purchase, giving you a more accurate picture of your financial situation at any given time.

Why Is My Statement Balance More Than My Current Balance?

You may have a zero balance on one card and a positive balance on the other, or the two balances could differ depending on when you make payments and how much you charge. This difference is because your statement balance records your balance on a given date, while your current balance is constantly updated based on payments and purchases. Your current balance may be less than the balance shown on your credit card statement if you have paid off your balance in full after the close of your billing cycle and have not made any additional purchases. However, if you've made any purchases after your statement closed, you'll have a higher balance now than you did then.

Which Balance Should You Pay?

If your statement balance was $0 at the beginning of the billing cycle, or if you paid your previous balance in full by the payment due date, then you won't have to pay any finance charges if you pay your statement balance by the due date shown on your statement. The "grace period" is now over. Make sure to pay off your statement in full before the grace period ends so you don't get hit with any late fees.

Should You Pay Your Statement Balance Or A Current Balance?

It's not always clear which balance on your credit card bill should be paid off first: the statement or the current balance. Either way, you can save money by not paying interest. You have fully satisfied your financial obligations when you pay the full amount listed on your statement. Since you won't be carrying over any balance from the previous billing cycle, you won't have to worry about interest charges on those purchases for the following billing cycle. If you pay the current debt, you'll settle the amount due on your account and any fees incurred since the last billing cycle ended. It's an excellent idea because it will clear the amount, but it's not essential if you want to avoid interest charges.

Conclusion

If you want to keep your credit score as high as possible and always pay the right amount on your credit card bills, you need to be aware of the difference between your actual balance and the balance on your monthly statement. Perusing your credit card accounts is fundamental to assessing your financial situation. As part of this process, you should regularly check your credit card statements and balances. Keeping an eye on those two figures can help you maintain financial stability by allowing you to avoid interest charges and pay down or eliminate credit card debt more quickly. Pay close attention to your credit card statement balance because that's the amount that will likely be shared with credit reporting agencies. Because of this, your credit report balance may not accurately reflect your actual credit card debt.